Were you aware that as of March 2023, nearly 30% of PAN cardholders in India haven’t yet completed the process of linking their PAN with their Aadhaar card? This is a crucial step to facilitate smooth financial transactions and to ensure compliance with government regulations.

If you happen to be one of those individuals who haven’t yet linked their PAN with Aadhaar, there’s no need to worry. In this article, we’ll take you through a straightforward, step-by-step procedure for linking your PAN with Aadhaar.

By following these steps, you’ll remain on the right side of the law and avoid any potential disruptions in your financial activities.

Link Pan With an Aadhaar Card Requirements:

To determine if you’re eligible to link your PAN card with your Aadhaar card, you need to meet certain requirements as outlined by the government. The eligibility criteria for linking a PAN with an Aadhaar card are quite straightforward.

First and foremost, you must have both a PAN card and an Aadhaar card. Additionally, your name, date of birth, and gender on both cards should match. If there are any discrepancies, you’ll need to rectify them before proceeding with the linking process.

It is also important to note that individuals who’ve been assigned Aadhaar card numbers but haven’t yet received their physical cards can still link their PAN with the Aadhaar number. In such cases, the 28-digit Aadhaar enrollment ID should be used.

While linking your PAN with your Aadhaar card, it’s crucial to avoid common mistakes. Double-check the details you provide to ensure accuracy. For instance, make sure you enter your PAN and Aadhaar numbers correctly, without any typographical errors.

Also, ensure that your name, date of birth, and gender match exactly as mentioned on both cards. Failure to provide accurate information may lead to the linking process being rejected.

Required Documents for linking pAN with aadhaar:

What documents do you need to gather to link your PAN card with your Aadhaar card?

To successfully link your PAN card with your Aadhaar card, you’ll need to have the following documents ready:

- PAN Card: Make sure you have a copy of your PAN card handy.

- Aadhaar Card: Keep a copy of your Aadhaar card ready for submission.

- Proof of Identity: Provide valid proof of identity such as a passport, driving license, or voter ID card.

- Proof of Address: Submit a document that acts as proof of your address, such as a utility bill or rental agreement.

- Passport-sized Photograph: Keep a recent passport-sized photograph ready for submission.

To link your PAN card with your Aadhaar card, you can follow the document submission process either online or offline.

Online, you can visit the Income Tax Department’s e-filing website and complete the process.

Offline, you can visit the nearest PAN service center or Aadhaar enrollment center to submit the required documents.

While linking your PAN card with your Aadhaar card, it’s important to avoid common mistakes such as providing incorrect information or mismatched details. Double-check all the details before submitting the documents to ensure a smooth process.

how to link pan with aadhaar card?

Once you have gathered all the necessary documents, the next step is to visit the official website to link your PAN card with your Aadhaar card. To do this, follow these simple steps:

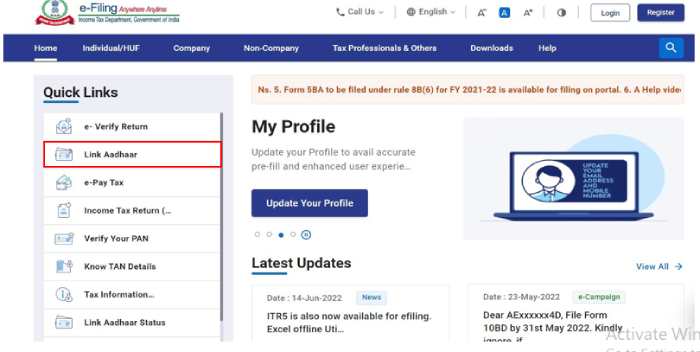

- Open your web browser and go to the official website of the Income Tax Department of India (https://www.incometaxindiaefiling.gov.in/home).

- Look for the ‘Link Aadhaar’ option on the homepage and click on it.

- You’ll be redirected to a new page where you need to enter your PAN card number, Aadhaar card number, and other required details such as your name, date of birth, and gender.

- Double-check all the information you have entered to ensure its accuracy.

- After verifying the details, click on the ‘Link Aadhaar’ button to proceed.

- A confirmation message will be displayed on the screen indicating that your PAN card has been successfully linked with your Aadhaar card.

It is important to note some common mistakes to avoid while linking your PAN card with your Aadhaar card. Make sure that the information you enter matches exactly with the details mentioned on both cards. Any discrepancies can lead to errors or rejection of the linkage request.

Linking your PAN card with your Aadhaar card is important for several reasons:

- It helps in avoiding any discrepancies and helps in maintaining accurate financial records.

- It ensures that your personal information is linked across various government databases.

- It helps in preventing tax evasion and fraudulent activities.

- It makes it easier for the government to track financial transactions and detect any suspicious activities.

- It’s a mandatory requirement as per the Income Tax Department of India.

Verify Linking Status and Troubleshoot Issues:

To ensure that your PAN card is successfully linked with your Aadhaar card, it’s important to verify the linking status and troubleshoot any issues that may arise during the process.

Checking the linking status is a simple procedure that can be done online. Visit the official website of the Income Tax Department and navigate to the ‘Link Aadhaar’ section. Enter your PAN and Aadhaar details and click on the ‘Submit’ button. The website will display the current linking status of your PAN and Aadhaar cards.

In case you encounter any errors or issues during the linking process, it’s crucial to troubleshoot them promptly. Some common errors that may occur include mismatched names, incorrect Aadhaar details, or technical glitches.

To resolve these errors, you can update your Aadhaar details by visiting the Aadhaar Enrollment Center or through the official UIDAI website or mobile app. Provide the necessary documents to support the changes you want to make, and the authorities will update your Aadhaar information accordingly.

Verifying the linking status and troubleshooting any issues that arise are essential steps to ensure the successful linking of your PAN and Aadhaar cards. By staying proactive and addressing any errors promptly, you can avoid complications and ensure compliance with government regulations.

Frequently Asked Questions:

The deadline for linking your PAN with your Aadhaar card is fast approaching. Failing to do so may have consequences. It is essential to complete this process to avoid any potential issues.

Yes, you can link multiple PAN cards to a single Aadhaar card. This process helps eliminate duplicate or fake PAN cards and ensures better tracking of financial transactions for individuals.

Linking your PAN with Aadhaar is important for NRIs. It ensures seamless financial transactions and prevents tax evasion. The process involves visiting the e-filing portal, entering details, and verifying through OTP or biometric authentication.

On average, it takes about 2-3 weeks for the pan-aadhaar linking process to be completed. However, some common issues that people face during this process include incorrect details or mismatched information between the two cards.

If you fail to link your PAN with Aadhaar within the deadline, you may face consequences such as your PAN becoming inactive. However, there are alternatives such as using the e-filing portal or visiting a PAN service center to link them.

Conclusion:

In conclusion, linking your PAN card with your Aadhaar card is a simple process that can be completed online.

Just like connecting pieces of a puzzle, this linking process ensures seamless integration of your personal information.

By following the step-by-step instructions provided on the official website, you can easily verify the linking status and troubleshoot any issues that may arise.

Remember, linking your PAN with your Aadhaar card is essential for various financial transactions and compliance with government regulations.

- How to Easily Track Your PGVCL Bill Payment Status? - March 13, 2024

- How to Apply for a Ration Card in Karnataka Easily? - March 13, 2024

- How to Link EPF with Aadhaar – Online & Offline - March 12, 2024