If you’ve lost your PAN card, don’t worry – applying for a replacement is a straightforward process. While it may seem like a hassle to go through all the paperwork again, it’s important to have a valid PAN card for various financial transactions and identification purposes.

So, let’s delve into the steps you need to take in order to apply for a new PAN card if yours has been lost. Keep reading to find out how you can easily get your PAN card back and get back on track with your financial obligations.

Gather Required Documents for applying PAN Card:

To apply for a lost PAN card, you’ll need to gather all the necessary documents.

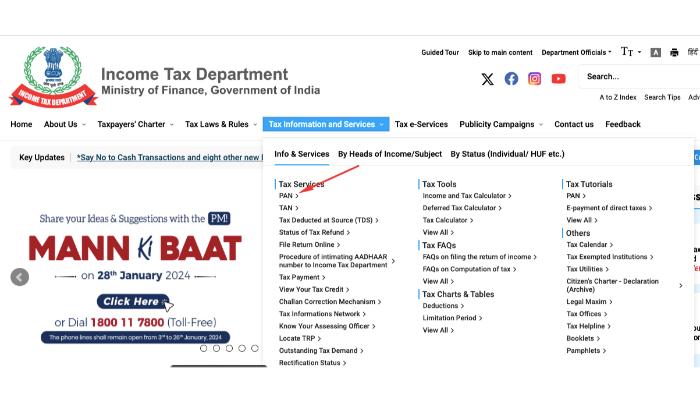

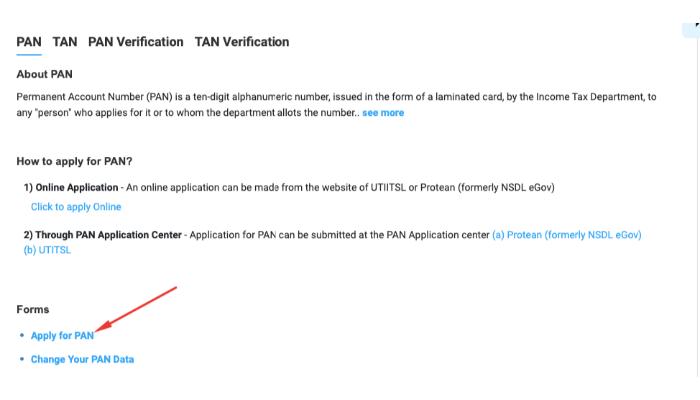

- The first step is to apply online by visiting the official website of the Income Tax Department of India . There, you’ll find the option to apply for a lost PAN card.

- Once you have filled out the application form, you’ll need to gather a few essential documents to complete the process.

- Firstly, you’ll need to provide proof of identity. This can be in the form of a valid passport, Aadhaar card, or voter ID card.

- Secondly, you’ll need to provide proof of address, which can be a utility bill, bank statement, or rental agreement.

- Additionally, you’ll need to submit a recent passport-sized photograph.

It is important to note that all documents must be self-attested and submitted along with the application form. Once you have gathered all the necessary documents, you can either submit them online or visit a PAN card center to complete the process. It’s advisable to double-check the requirements and guidelines provided by the Income Tax Department to ensure a smooth application process.

How to Fill the Application Form For Lost PAN?

You can begin the process of filling out the application form for a lost PAN card by visiting the official website of the Income Tax Department of India. Follow this step-by-step guide to ensure a smooth and error-free application process:

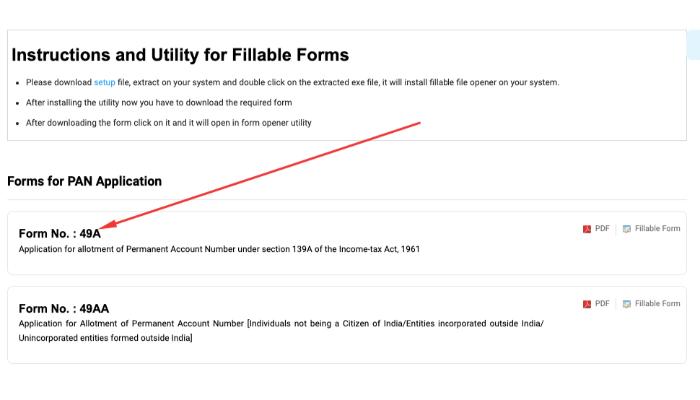

- Download the Form: Go to the official website and download the ‘Request for New PAN Card or/and Changes or Correction in PAN Data’ form (Form 49A). Save it to your computer for easy access.

- Fill in the Details: Open the downloaded form and carefully fill in all the required details. Double-check for any errors or omissions to avoid delays in processing your application.

- Avoid Common Mistakes: While filling out the form, ensure that you don’t make common mistakes such as using initials instead of the full name, incorrect date format, or mismatched signatures. These mistakes can lead to rejection or delays in processing your application.

Submit the Application Through Online or Offline for PAN:

Once you have filled out the application form for a lost PAN card, you have the option to submit it either online or offline:

Online Submission for :

- Visit the official website of the Income Tax Department.

- Follow the provided instructions for the application process.

- Upload scanned copies of required documents.

- Make the payment for the application online.

- Benefit from quick processing and reduced error chances.

Offline Submission:

- Visit the nearest PAN card center or authorized service provider.

- Obtain and fill out the physical application form accurately.

- Attach necessary supporting documents, like proof of identity and address.

- Submit the completed form and documents at the center.

- Pay any applicable fees via cash or demand draft.

Whether you choose to submit your application online or offline, it’s essential to ensure that all the information provided is accurate and complete. This will help expedite the process and avoid any delays or complications.

Pay the Application Fee for Lost PAN:

If you have chosen to submit your application offline, the next step is to pay the application fee. Follow these steps to complete the payment process:

- Visit the nearest UTIITSL or NSDL branch: Locate the nearest branch of UTIITSL or NSDL, the authorized agency for PAN card services. Visit the branch in person and inform the staff that you want to pay the application fee for a lost PAN card.

- Fill out the Challan form: The staff will provide you with a Challan form. Fill out the form accurately, providing your personal details and the purpose of payment (application fee for a lost PAN card).

- Make the payment: After filling out the Challan form, submit it along with the required fee amount. The staff will provide you with a receipt as proof of payment.

Alternatively, if you prefer to apply online, you can pay the application fee through various payment methods. These may include credit cards, debit cards, net banking, or UPI. Simply select your preferred payment method during the online application process and follow the instructions provided.

Remember to keep the receipt or transaction reference number as proof of payment for future reference.

Track the Status of Your PAN Card Replacement:

Have you ever wondered how to track the status of your PAN card replacement? It’s crucial to keep a backup copy of your PAN card, as it serves as a vital identification document for various financial and legal transactions. Losing your PAN card can be a hassle, but tracking its replacement status can provide you with peace of mind.

To track the status of your PAN card replacement, you can visit the official website of the Income Tax Department of India and navigate to the ‘Track PAN Card’ section. Here, you’ll be required to enter your application number or acknowledgment number to check the progress of your replacement request. The website will provide you with real-time updates on the status of your PAN card replacement, allowing you to stay informed throughout the process.

However, there may be instances where your PAN card replacement is delayed. If this occurs, it’s advisable to first contact the helpline number provided on the Income Tax Department’s website. The helpline can provide you with specific information regarding the delay and guide you on the steps to take to resolve the issue. Additionally, you can visit the nearest PAN card office and speak to a representative for further assistance.

Frequently Asked Questions:

If you are currently residing outside of India and have lost your PAN card, you can apply for a PAN card replacement from abroad. The process for NRIs is slightly different, but you can still get it done.

If you’ve lost your acknowledgment number after submitting your PAN card application, don’t worry. There are ways to track it, and if all else fails, you can reapply by following the necessary steps.

You’re wondering if you can speed up the process of replacing your lost PAN card. Well, good news! You can expedite the pan card replacement even if you’re abroad. Just follow the necessary steps and you’ll have your card in no time.

After submitting your application for a pan card replacement, it usually takes around 15-20 working days to receive the new card. Make sure you have all the necessary documents for the replacement process.

Yes, you can update your address and other personal details while applying for a PAN card replacement. The address update process requires you to submit documents such as proof of address and identity.

Conclusion:

So there you have it, the simple and straightforward steps to apply for a PAN card if it’s lost. Just gather your documents, fill out the form, submit it online or offline, pay the fee, and track the status.

It’s as easy as pie! Now you can go ahead and get your PAN card replaced without breaking a sweat. Happy filing!

- What is the Minimum Age for Online Gaming in India? (Explained) - June 27, 2025

- Can I Use UPI Apps for Betting in India? (2025 Guide) - June 26, 2025

- Managing Your Digital Subscriptions: Recharges & Cancellations - May 29, 2025